Latest updates

Media contact

Are you interested in our latest news or working on a Pāmu story and need to get in touch?

24 Jul 2025

Focused Farming Pays Off: Pāmu Eyes Record-Breaking Profits

Landcorp Farming Limited trading as Pāmu advises that it has narrowed its forecast range for Net Operating Profit (NOP) for the financial year ending 30 June 2025, reflecting its preliminary unaudited results

23 Jul 2025

Roz Urbahn Appointed as Chief Corporate Services Officer at Pāmu

01 Jul 2025

Applications Open for Pāmu 2026 Farming Apprenticeship Scheme

24 Jun 2025

Open Farm Day at Edenham Station

04 Jun 2025

Delivering value to New Zealand

03 Jun 2025

Join Us at Fieldays 2025: Science, Sustainability and Smarter Farming

28 May 2025

Open Farm Day at Rangitāiki Station: Sharing Our Safe and Profitable Farming Journey

26 May 2025

NZ Farm Dog DNA Study Reveals Top 5 Inherited Health Risks

06 May 2025

Safety at the forefront of Rangitāiki Open Day

05 May 2025

Pāmu announces Open Farm Days for FY 2025/2026

01 May 2025

Pāmu Honours Legacy of Dr Warren Parker with Memorial Covenant and Scholarship for Future Agricultural Leaders

14 Apr 2025

Touring the calf shed conversions at Weka

07 Apr 2025

Molesworth Station achieves TB-Free status after 40 years of eradication efforts

27 Mar 2025

Pāmu partners with Mercury to launch Northland’s first wind farm at Ōmāmari

03 Mar 2025

Pāmu announces half-year result

27 Feb 2025

Pāmu takes action on wilding conifers to protect land and future generations

27 Feb 2025

Open Farm Day at Weka to share dairy beef opportunities for farmers

25 Feb 2025

Pāmu opens the gates to townfolk at Pinta

13 Feb 2025

Feed efficiency and methane facility open day

30 Jan 2025

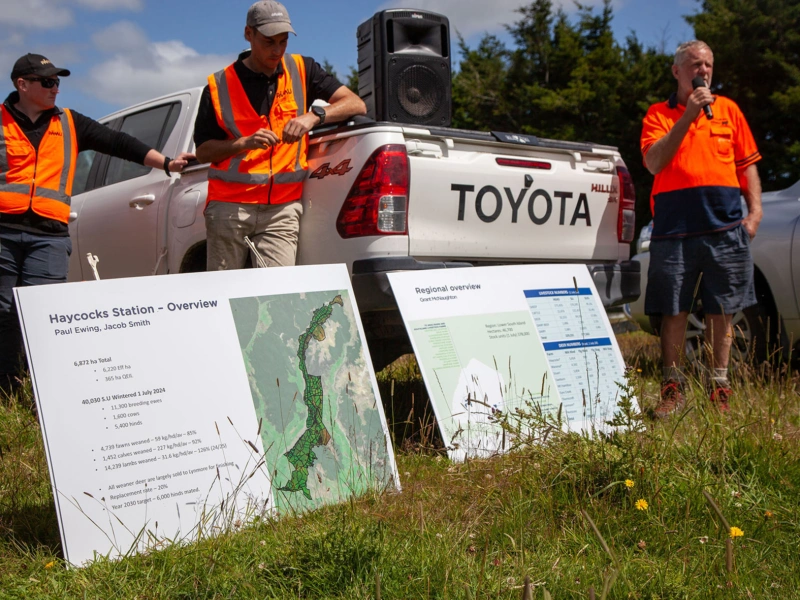

Deer in Te Anau Open Day

23 Jan 2025

Cultivating agricultural talent - Pāmu Apprenticeship Scheme underway

19 Dec 2024

Blending livestock and forestry brings benefits

06 Dec 2024

Case study: Battling Madagascar ragwort in Northland

05 Dec 2024

Pāmu and LIC join forces to progress dairy beef farming

Media contact

Are you interested in our latest news or working on a Pāmu story and need to get in touch?